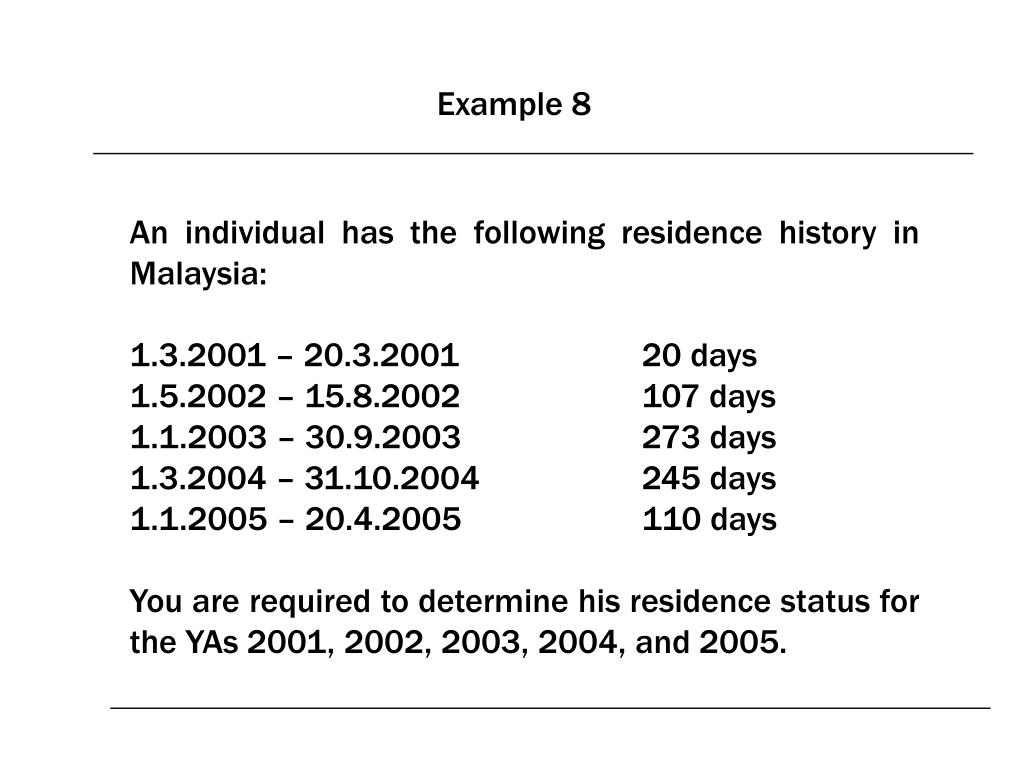

Check your eligibility for PR status. Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident.

Tax Guide For Expats In Malaysia Expatgo

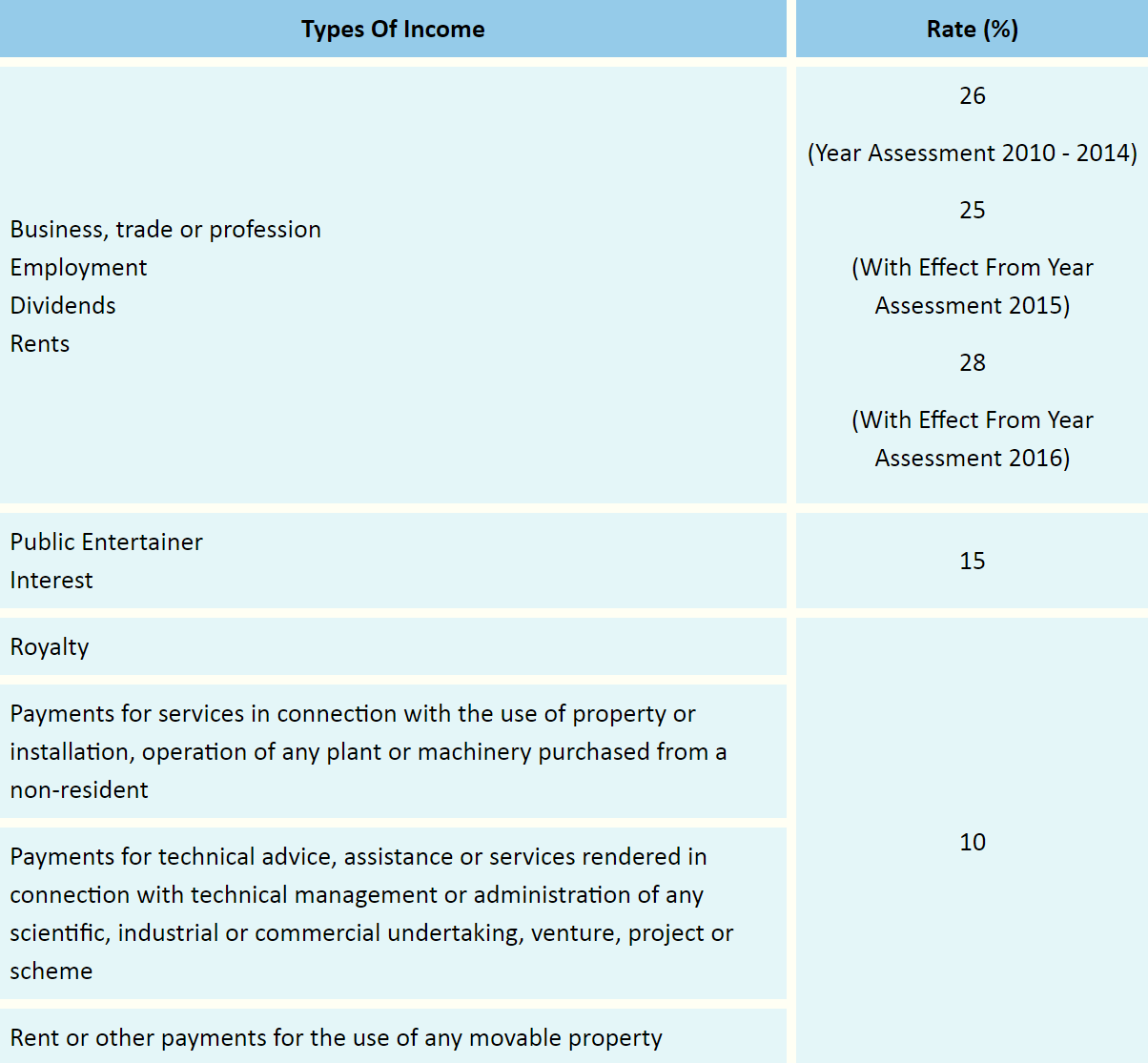

Non-residents pay a flat 28 on taxable income so it is advantageous for your employee to qualify as a resident.

. Another advantage of the resident status is that deductions from income are available while non-residents cannot use those to reduce their taxable income. Significance Of Residence Status 41 Residence status for income tax purposes Residence status is a question of fact and is one of the main criteria that. Permanent Residence Application Entry Permit is issued under Section 10 Immigration Act 195963 which allows the non-citizen to remain in Malaysia after the expiry of a valid Pass.

In Malaysia or registering a branch in Malaysia. It is very crucial for one especially expatriate in Malaysia to understand residence status. Residence Pass is a pass issued to any foreign national who falls under any category specified under Regulation 16A Immigration Regulations 1963.

If in doubt contact the Immigration Department. The very first requirement to apply for PR status is a person must live in Malaysia for a minimum five consecutive years. Apply by submitting your documents at the Immigration Authority of Malaysia.

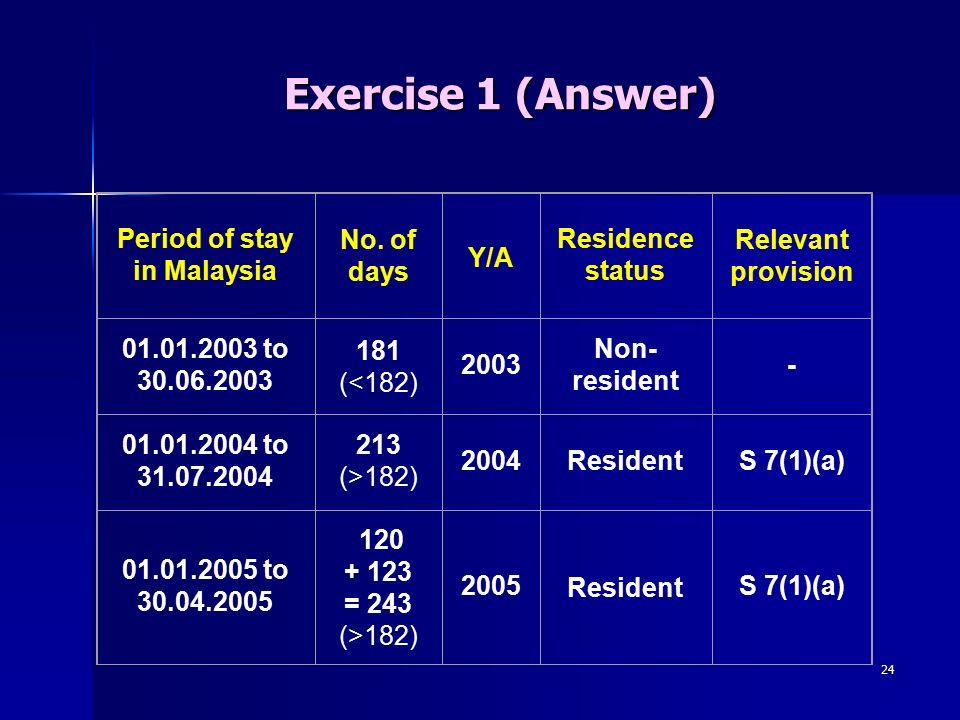

For instance under Section 71a of Income Tax Act ITA 1967 if he stays in Malaysia for a total of 182 days or more in one year he is qualified as a tax resident in Malaysia and thus enabling him to enjoy the tax. All Entry Permit application should be done at the Immigration. This Permit enable the holder to apply for the Permanent Resident status with National Registry Department.

Permanent Residency Status in Malaysia is granted to Any Foreign Citizen under the Immigration Act and Regulations 195963. A persons residency status is determined based on the number of days he is physically present in Malaysia in a year. Tax residents pay progressive income tax rates of 1-28 based on income level.

In Malaysia for less than 182. Biological child to a Permanent Resident aged 18 and below. Attend an immigration interview and undergo police vetting.

There are four rules to determine tax resident status of an individual in Malaysia. Generally residence status for tax purposes is based on the number of days spent by the individual in Malaysia and is independent of citizenship. As for a tax resident the effective tax rate is approximately around 9 RM9000.

If you need any advise on tax filing tax residence. Residence status affects the amount of tax paid. Malaysia Permanent Resident Requirements.

In Malaysia in a tax year for 182 days or more. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more. Branches of foreign corporations in Malaysia are generally treated as.

Headquarters of Inland Revenue Board Of Malaysia. Residents and non-residents in Malaysia are taxed on employment income accruing in or derived from Malaysia. The source of employment income is the.

Note that spending part of a day in Malaysia counts as being physically present for the whole day - for example someone who arrives in Malaysia at 11pm and leaves. An income earner earning RM100000 if heshe is a non tax resident the tax rate would be 30 which is RM30000. Gather all the paperwork and approvals required for your application route.

The Certificate of Residence COR is issued to confirm the residence status of the taxpayer enabling them to claim tax benefit under the DTA and to avoid double taxation on the same income. A company is resident in Malaysia if at any time during that basis year the management and control of its business is in Malaysia. 42 A resident and a non-resident company in Malaysia is taxed in the same.

Even if a person is married to a Malaysian This first rule needs to be crossed out first before proceed on PR status application. The residence status of subsidiaries of foreign corporations would be determined by paragraphs 81b and 81c of the ITA 1967. CATEGORY 4 - A PERSON WITH FAMILY TIES WITH A PERMANENT RESIDENT OF MALAYSIA.

Determination of Residence Status. Within those five years. Malaysia has an extensive network of Double Taxation Agreement DTA with treaty partners.

B he is in Malaysia in that basis year for a period of. Headquarters of Inland Revenue Board Of Malaysia. Income tax in Malaysia is territorial in scope and based on the principle source regardless of the tax residency of the individual in Malaysia.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. Significance of Residence Status 41 Residence status is a question of fact and it is one of the main criteria that determines the tax treatment and tax consequences of a company or body of persons. Resident status is determined by reference to the number of days an individual is present in Malaysia.

32 Resident individual is an individual resident in Malaysia for the basis year for a year of assessment as determined under section 7 and subsection 71B of the ITA 1967. Photocopy of applicants passport. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber.

Any Foreign Citizen which had been granted with Permanent Resident Status will be issued with an Entry Permit and Identification Card MyPR.

Question Regarding Tax Residence Status For Tax Clearance R Malaysia

Malaysia S Updated Protocols For Positive Covid 19 Cases May 2022

Procedures For Travellers Entering Malaysia From 1 April 2022 Updated On 30 July 2022 Home Portal

Ppt Chapter 2 Resident Status For Individuals Powerpoint Presentation Id 6980906

Individual Income Tax In Malaysia For Expatriates

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Microsoft Word Employment Application Template Wovensheet Co With Regard To Employment Application Template Microsoft Word Professional Template

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Procedures For Travellers Entering Malaysia From 1 April 2022 Updated On 30 July 2022 Home Portal

Undertaking Letter Format Employee

Protocols For All Travellers Entering Malaysia From 1 April 2022

Jan 2022 Update What To Do If You Get Covid 19 Or Are A Close Contact In Malaysia

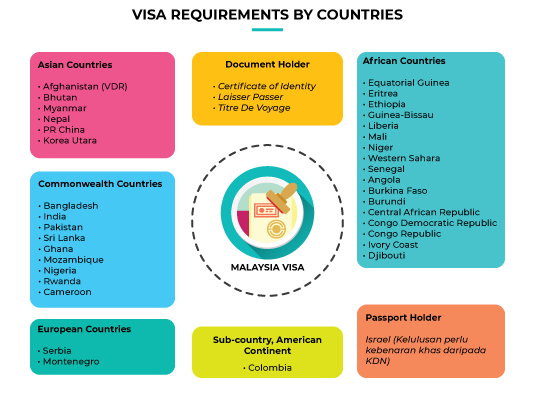

Mygov Getting Tourism Information Travel To Malaysia Entry Requirements Into Malaysia Visa Requirement Based On Country

Tax Guide For Expats In Malaysia Expatgo